Warnings and Errors in Payroll

Troubleshoot warnings and errors you may find while reviewing payroll.

What are Warnings and Errors?

Troubleshooting

- Error Messages

- Warning Messages

What are Warnings and Errors?

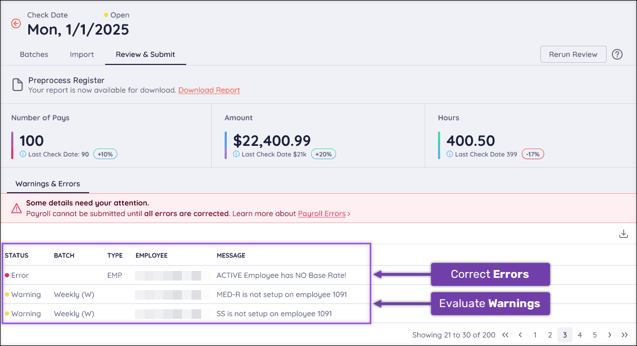

As humans, sometimes we make mistakes! The Warnings and Errors section of the Review & Submit page alerts you to any potential issues before you submit your payroll.

Troubleshooting

These tables provide a course of action for potential Warning and Error messages displayed during payroll Review. Each table is sorted alphabetically by Code, then alphabetically by Message.

Note: Payroll cannot be submitted until all Errors are corrected. While Warnings can be bypassed/accepted, we strongly advise reviewing all Warning messages and taking corrective action where needed.

If you encounter a Warning or Error not on this list and need assistance or more information, please contact Checkwriters Client Support at support@checkwriters.com.

Error Messages

| Code | Error Message | Locate this issue | Corrective action |

|

Employee |

ACTIVE Employee has NO Base Rate |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Employee |

Employee Base Rate is missing a START DATE |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Employee |

Employee is W2 but missing FITW |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Employee |

Gender Missing |

HR Admin → Manage Employees → Employee Center → Select |

Use the Gender (for compliance purposes) drop-down to select the appropriate gender. |

|

Employee |

Hire Date Missing |

HR Admin → Manage Employees → Employee Center → Select |

In the Employee Information section, enter the employee’s hire date in the Hire Date field. |

|

Employee |

SOC code is needed per state reporting requirements. Enter SOC code in EE Demographics. |

HR Admin → Manage Employees → Employee Center → Select |

In the Additional Info section, enter the appropriate Standard Occupational Classification (SOC) code for the employee. Not sure which code to use? Find the SOC code on US Bureau of Labor Statistics website. |

|

Employee |

SSN Missing/Invalid |

HR Admin → Manage Employees → Employee Center → Select |

For security purposes, Checkwriters must handle any issues with Social Security Numbers (SSN). Please contact Client Support at Support@checkwriters.com for assistance. |

|

Payroll |

Employee Direct Deposit TRANSIT# is incorrect |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Payroll |

Payroll cannot be submitted past your scheduled check date. |

|

Please contact Checkwriters Client Support at Support@checkwriters.com for assistance. |

|

Payroll |

Pay Type is Blank |

Payroll → Dashboard → Select Enter & Review → Select Enter Pay Data for the appropriate batch → Use the Employees drop-down menu to select the appropriate employee |

Use the Pay Type drop-down menu to select the appropriate Pay Type. The standard Pay Type is Regular. |

|

Tax |

EE Tax ERROR: Check contains multiple lines with the same tax code |

Payroll → Dashboard → Select Enter & Review → Select Enter Pay Data for the appropriate batch → Use the Employees drop-down menu to select the appropriate employee |

For a regular batch: Locate the Detail Entry grid lines with the same tax code. If applicable, consolidate the information into one line. Delete the extra line using the For a VM batch: Please contact Checkwriters Client Support at Support@checkwriters.com for assistance. |

|

Employee |

Employee FITW end date has expired. |

HR Admin → Manage Employees → Employee Center → Select |

If the previous FITW was accidentally end-dated incorrectly, select |

|

Payroll |

The payroll appears to be empty. |

Payroll → Dashboard → Select Enter & Review |

This error indicates that there are no checks in any of the batches for the selected check date. This may indicate multiple things:

|

|

Payroll |

It appears that no employees are being paid. |

Payroll → Dashboard → Select Enter & Review |

This error indicates that there are checks in the payroll, but no data (hours, amounts, auto pays) entered for any of the checks. To remedy this, select Enter Pay Data beside a batch and enter the appropriate payroll data for each employee. |

Warning Messages

| Code | Warning Message | Locate this issue | What to check |

|

Employee |

Birth Date Missing |

HR Admin → Manage Employees → Employee Center → Select |

Enter the employee’s date of birth in the Birth Date field. Select save. |

|

Employee |

Direct Deposit Bank Account Add - New. |

HR Admin → Manage Employees → Employee Center → Select |

Verify that the direct deposit change is legitimate. Verify the account number with your employee. |

|

Employee |

Direct Deposit Bank Account has been changed. |

HR Admin → Manage Employees → Employee Center → Select |

Verify that the direct deposit change is legitimate. Verify the account number with your employee. |

|

Employee |

Direct Deposit Transit Number has been Add - New |

HR Admin → Manage Employees → Employee Center → Select |

Verify that the direct deposit change is legitimate. Verify the routing/transit number with your employee. |

|

Employee |

Direct Deposit Transit Number has been changed |

HR Admin → Manage Employees → Employee Center → Select |

Verify that the direct deposit change is legitimate. Verify the routing/transit number with your employee. |

|

Employee |

Employee does not have all of the MAPFML taxes assigned to them |

HR Admin → Manage Employees → Employee Center → Select |

Check to see which of the following MAPFML taxes your employee is missing: MAFLI-EE, MAFLI-ER, MAPML-EE, MAPML-ER Select Repeat for all missing MAPFML tax codes. |

|

Employee |

Employee is missing (MED) entry |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Employee |

Employee is missing (MED43) entry |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Employee |

Employee is missing (MED-R,MED43-R,MEDVI-R) entry |

HR Admin → Manage Employees → Employee Center → Select |

These “-R” codes denote an employer tax. Select |

|

Employee |

Employee is missing (SS) entry |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Employee |

Employee is missing (SS43) entry |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Employee |

Employee is missing (SS-R,SS43-R,SSVI-R) entry |

HR Admin → Manage Employees → Employee Center → Select |

These “-R” codes denote an employer tax. Select |

|

Employee |

Employee is missing FUTA entry |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Employee |

Employee is missing SITW entry |

HR Admin → Manage Employees → Employee Center → Select |

Select |

|

Payroll |

Employee being paid at a rate of $400 or more per hour |

HR Admin → Manage Employees → Employee Center → Select |

Verify that the rate is correct. Change rate if incorrect. |

|

Payroll |

Employee hours greater than 99 |

Payroll → Dashboard → Select Enter & Review → Select Enter Pay Data for the appropriate batch → Use the Employees drop-down menu to select the appropriate employee |

Verify that the number of hours is correct. Change the number of hours if incorrect. |

|

Payroll |

Inactive Employee is being Paid |

Payroll → Dashboard → Select Enter & Review → Select Enter Pay Data for the appropriate batch → Use the Employees drop-down menu to select the appropriate employee |

Verify that the pay is correct. If it is not correct, delete the check for that employee. |

|

Payroll |

The Check Date you are about to Submit is for a Date that has already Passed |

|

Please contact Checkwriters Client Support at Support@checkwriters.com for assistance. |

|

Payroll |

There are pending time off requests waiting approval for the current pay period |

HR Admin → Time Off Center → Time Off Calendar → Request Tab → Select |

Approve or deny the request. If you approve the request, you will have to go back into the batch and manually enter the appropriate/applicable hours. |

|

Employee |

NEW HIRE Warning: Special Character in Last Name |

HR Admin → Manage Employees → Employee Center → Select |

Remove the special character from the employee’s name and replace with a standard character. Accented characters are not accepted, e.g. á, ë, ô, ñ. |

|

Employee |

Employee Level Warning: Missing WCC Code |

HR Admin → Manage Employees → Employee Center → Select |

Assign a workers comp code to the employee. |

|

Employee |

Employee Level Warning: Address1 Missing |

HR Admin → Manage Employees → Employee Center → Select |

Enter the employee's address. |

|

Employee |

Employee Level Warning: City Missing |

HR Admin → Manage Employees → Employee Center → Select |

Enter the employee's city. |

|

Employee |

Employee Level Warning: State Missing |

HR Admin → Manage Employees → Employee Center → Select |

Enter the employee's state. |

|

Employee |

Employee Level Warning: Zip Code Missing |

HR Admin → Manage Employees → Employee Center → Select |

Enter the employee's zip code. |

|

Payroll |

Payroll Entry Warning: Employee Gross Pay > $50k |

Payroll → Dashboard → Select Enter & Review → Select Enter Pay Data for the appropriate batch → Use the Employees drop-down menu to select the appropriate employee |

Verify that the gross pay is correct. If incorrect, edit the payroll data as needed. |

More Info: Your company may suppress some tax warnings for exempt employees. Learn more about the Suppress Missing Tax Warnings checkbox.