Security Control Center: Contacts

Checkwriters Contacts lists all active contacts at your company. These Contacts are used to vet individuals calling in to Checkwriters for assistance and to identify which individuals at your company should receive Checkwriters notifications.

The Contacts page allows your company's admin users to view and manage all contacts in the company.

Important: For privacy and security reasons, individuals calling into Checkwriters for support must be listed as an official Contact. If the caller is not listed as a Contact, they should follow up with their company’s Checkwriters Administrator.

Layout

Add or Edit a Contact

- Demographics

- Checkbox Selections

- Dropdown Selections

- Notes

Delete a Contact

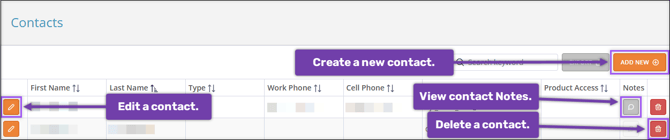

Layout

Users with access to HR Admin (module) → Security Control Center → Contacts can add, modify, and delete Contacts.

- Select Add New to create a new contact.

- Select Edit

to edit an existing contact.

to edit an existing contact. - Select Delete

to delete an existing contact.

to delete an existing contact. - Select Notes

to view any notes associated with a contact.

to view any notes associated with a contact.

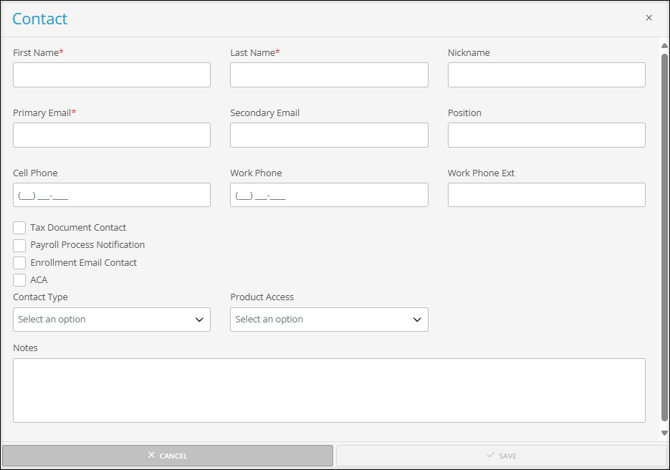

Add or Edit a Contact

When you select Add New to create a new contact or Edit to edit an existing one, the Contact Editing aside will appear with setup fields. Red asterisks indicate required fields.

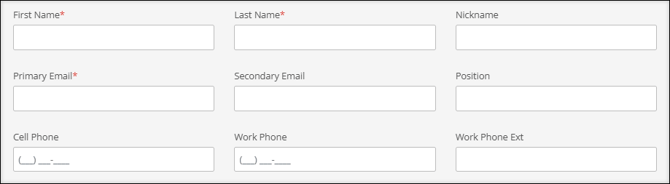

Demographics

Enter the contact's important demographic information. Required fields are marked with a red asterisk.

Note: If a contact is associated with multiple companies, the demographic information for that contact cannot be edited. For further assistance, please contact Checkwriters Client Support at support@checkwriters.com.

- First Name (required)

- Last Name (required)

- Nickname

- Primary Email (required)

- Secondary Email

- Position

- Cell Phone

- Work Phone

- Work Phone Ext

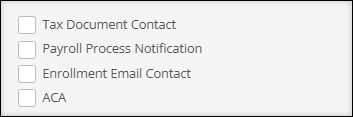

Checkbox Selections

By checking one or more of these options, you are designating the Contact as someone to receive email communication on the specified topic. An individual may have no checkboxes selected if they are not to receive email communication about any of the topics below.

Tax Document Contact

This contact will be listed on all tax-related documents, including quarterly packets.

Warning: One contact must be designated as the Tax Document Contact, and only one contact can have this designation. If no Contact has been assigned as the Tax Document Contact, a Warning banner will display across the top of the page.

Important: Because your company can only have one Tax Document Contact, if a Contact in the system already has this designation and a new Contact is created with this checkbox selected, the new Contact will become the Tax Document Contact, overriding previous selections.

For example:

- Contact A is assigned the Tax Document Contact checkbox.

- Contact B is added with the Tax Document Contact checkbox selected.

- After Contact B’s information is saved, Contact B becomes the only Tax Document Contact. This action removes the Tax Document Contact checkbox selection from Contact A.

Payroll Process Notification

This contact will be notified, via email, every time payroll is processed. Multiple contacts may have this selection.

Enrollment Email Contact

When an employee is invited to register for an Employee Self-Service (ESS) account, this contact will be referenced in the enrollment email. Multiple contacts may have this selection.

ACA

This contact should be included in any ACA email communications from Checkwriters. Multiple contacts may have this selection.

Dropdown Selections

Contact Type

Select a Contact Type designation for each contact. Checkwriters may use this information when vetting callers or reaching out to specific types of contacts.

- Accountant/Outside Administrator: This contact should be used for Accountants and other third-party individuals.

- Company Leadership/Management: This contact should be used for the company owner, head of business, or department manager, depending on your company structure.

- No Wage Access: This contact will be unable to discuss information about wages, rates, salary, and other pay information.

- Primary: Checkwriters will use this contact as a primary contact if we need to reach out to your company. This contact will also receive important email notifications, reminders, and updates.

- Secondary: Checkwriters will use this contact as a secondary contact if we need to reach out to your company.

- Time Management Contact: This contact will be able to discuss attendance and timekeeping for your company.

Product Access

By selecting a Product Access option from the dropdown, Checkwriters will use this information when vetting callers or to reach out to specific types of contacts. These designations are intended for general use. More nuanced needs can be specified further in the Notes section.

- HR Only: A contact with this designation will be able to discuss HR maintenance but cannot discuss payroll processing with our team.

- Payroll Only: A contact with this designation will be able to discuss payroll processing but cannot discuss HR maintenance with our team.

- Report Vault Only: A contact with this designation will only be able to discuss reporting with our team.

- Tax Returns Only: A contact with this designation will be able to discuss the Tax tab in the Report Vault with our team. This designation is often used for the Contact Type “Accountant/Outside Administrator.”

- Timesheet Only: A contact with this designation will only be able to discuss time and attendance with our team.

- Unlimited: A contact with this designation will be able to discuss all aspects of business with our team.

Notes

Use the Notes section to document any additional notes about this contact.

Delete a Contact

To delete a contact, select Delete ![]() on the contact row you wish to remove.

on the contact row you wish to remove.

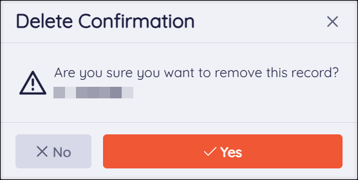

A Delete Confirmation pop-up dialog will display:

- Select Yes to remove the contact from this company page.

- Select No to keep the contact.

Important: Deleting a contact does not remove the user’s access to Checkwriters.

-

To remove a third-party user’s access to Checkwriters, please contact Checkwriters Client Support at support@checkwriters.com with your company code and “Remove third-party access” in the subject line.

-

To remove an admin or manager’s access to Checkwriters, unassign the user from their current role by navigating to HR Admin → Security Control Center → Role Security → Assignment. They will still have access to Checkwriters ESS.

-

Terminating an admin or manager will also remove their access to Checkwriters.

-