Payroll: Review & Submit

The Review & Submit tab of Payroll allows you to run important reports and fully review your payroll before submitting. It’s important to double-check your payroll before submitting to ensure there are no errors, omissions, or other issues.

Navigate to Review & Submit

Review Payroll

- Review Type

- Report Options

Warnings and Errors

Submit Payroll

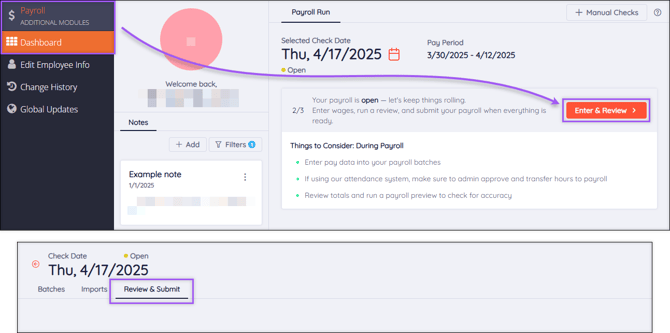

Navigate to Review & Submit

To access the Review & Submit tab, navigate to Payroll (module) → Dashboard → Get Started/Enter & Review → Review & Submit (tab).

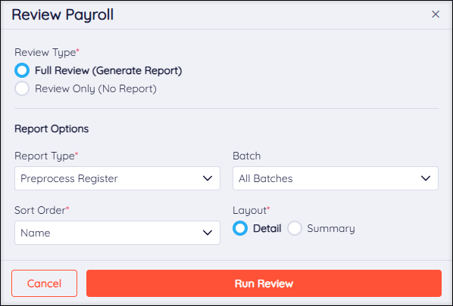

Review Payroll

When you’re ready to review your payroll, the Review Payroll pop-up will help you define your review parameters. If you exit the pop-up, select the Review Payroll button to return to it.

Review Type

Select whether you want to run a Full Review or Review Only.

- Full Review (Generate Report): Running a full review will allow you to generate one of three reports: the Preprocess Register, the Labor Audit, and the Labor Distribution.

- Review Only (No Report): Running this type of review will not generate any reports and will only show any flagged Warnings and Errors in the payroll.

Why should you run a payroll report? When you review your payroll reports, you ensure the information entered is accurate. If something looks inaccurate, you can correct the issue before submitting payroll.

Tip: Running the Preprocess Register Report is the best way to comprehensively review your payroll before submitting it.

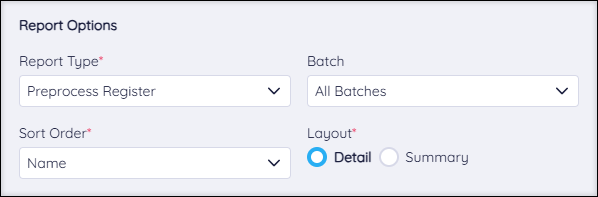

Report Options

If you choose to run a Full Review, you will be prompted to fill out the Report Options section.

Report type

Choose to run a Preprocess Register, Labor Audit, or Labor Distribution report.

- Preprocess Register: This report presents a preview of your submitted payroll, allowing you to verify the information before submitting. It also breaks down employee earnings, taxes, and other deductions.

- Labor Audit: This report breaks down labor allocation data by individual employee, showing how their labor is spread across departments.

- Labor Distribution: This report breaks down labor allocation data by department, showing employees' labor within each department.

Batch

Choose to view a report for payroll data in a specific batch or all payroll data in all batches.

Sort Order

Choose how your payroll data should be sorted.

- Name: Sorts alphabetically by employee name.

- ID: Sorts numerically by employee ID.

- Department/Name: Sorts alphabetically by department, then alphabetically by employee name within each department.

- Department/ID: Sorts alphabetically by department, then numerically by employee ID within each department.

Note: Employees holding positions in multiple departments will be displayed within their Home Department. You can view an employee’s Home Department by navigating to Employee Center → select employee → Information (tab) → Departments (tab). Learn more about Employee Center: Departments.

Layout

Choose to view the report in full Detail or as a Summary. We recommend viewing in Detail to get the most out of your review.

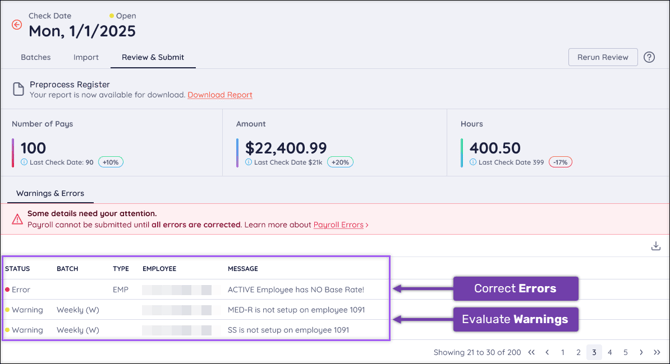

Warnings and Errors

After running a review, you should assess any warning and error messages before submitting your payroll.

- Error messages must be resolved before closing a batch and submitting payroll. Resolve errors by going back into the payroll entry and correcting any issues.

- Warning messages should be reviewed, and corrective action should be taken where needed.

Once all Warning messages have been considered and there are no Error messages associated with the batch, you should Rerun Review to once again confirm that all information is accurate.

More Info: Learn more about the different kinds of Warnings and Errors and how to address them.

Submit Payroll

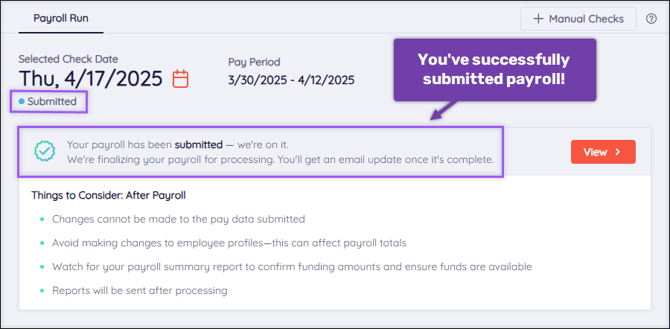

Once you have thoroughly reviewed your payroll, run reports, resolved errors, and taken corrective action on warnings where needed, you’re ready to submit your payroll.

Important: You must resolve any errors before you are allowed to submit your payroll.

- On the Review & Submit tab, select Submit Payroll.

- If you still have Warnings on the payroll, select the Accept Warnings checkbox and select Yes, Submit to confirm your submission.

- After submitting, you will see a green success notification on the screen and the Payroll Status will show as “Submitted.”

Tip: Check out the Things to Consider section after submitting payroll for helpful tips and important info.