Pay Type & Tip Earnings

When creating Earning Codes, think of Pay Types as “labels” that enable the system to correctly apply rules for IRS and State regulations, including taxability and W-2 box reporting. They’re most commonly used for special earnings, like tips, but the same logic applies to any earning that needs to follow specific reporting rules.

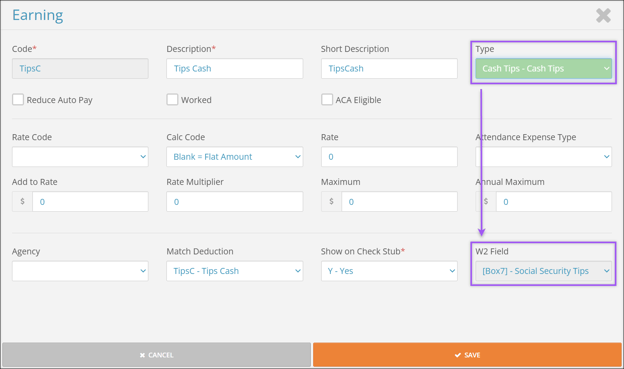

Tip Earnings

Cash, Check, and Credit Card tips must be reported in a separate W-2 box. Most companies will use different earning codes for each tip type since payout methods can vary. To ensure accuracy across all clients, it’s critical that these codes are set up correctly so tips are always reported properly on employee W-2s.

Find a list of your Earnings by navigating to Company (module) → Company Setup → Earnings.

On your Earning(s) code for tips

- Select Edit

to edit an existing Earning.

to edit an existing Earning. - In the Type dropdown menu, select the corresponding type that relates to the earning code.

- You’ll see that the W2 field box will automatically fill in based on your selection and grey out, so no changes can be made.

- Select Save.

Important: If you’ve made a change to a pay type and have previously paid out wages to this earning code in this calendar year, please notify us at TaxDepartment@Checkwriters.com.