How do I use the Fringe tab?

The fringe tab is a powerful tool that can be used to post fringe benefits and recurring payments to employees.

Adding/Editing Fringe Earnings

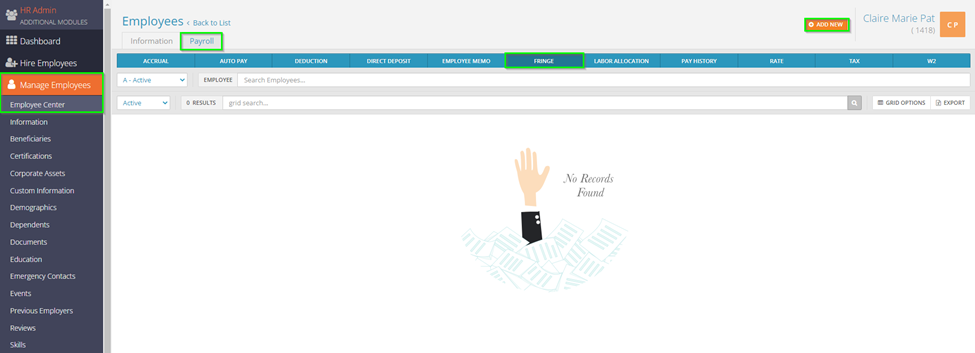

Fringe, similar to Auto Pay, is a great tool to use to pay your employees recurring amounts each payroll, specifically additional payments on top of their salary or hours. Select the employee you would like to edit under Manage Employees > Employee Center in the HR Admin module. Navigate to their Fringe tab.

You will see any current fringe earnings the employee has set up. To add new fringe earnings, select Add New in the top right.

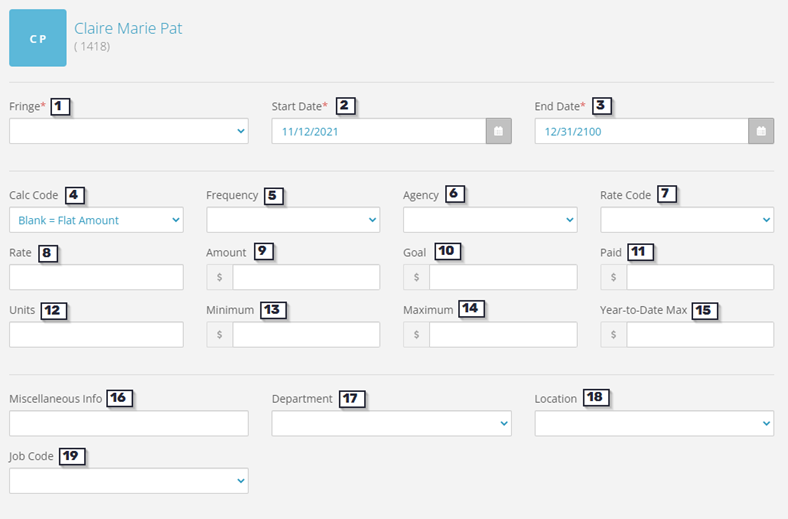

This will bring up the Fringe edit screen. Below is an explanation of the various fields you can fill in:

- Fringe – this is where you will select the earning code you want to pay the employee with.

- Start Date – the first check date this fringe should be active for.

- End Date – the last check date this fringe should be active for.

- Calc Code – this stands for Calculation Code. It determines how the Rate/Amount is calculated. With it left as Blank = Flat Amount, then the fringe will calculate as a flat dollar amount (depending on what you input). Clicking on this box will reveal a dropdown menu. An example of a different calc code would be a percentage calculation.

- Frequency – the frequency in which this fringe will appear. If it is to appear each payroll, then this will be left blank. If it should be withheld at a different frequency (IE, Monthly instead of Weekly), you will pull in a Frequency.

- Agency – this will tell the system to generate an Agency Check, or a payment to a third party. Agencies must be set up on the Company level.

- Rate Code – like Auto Pay, if you are to pay out your employee for a number of hours, you can pull in a rate code here to multiply those hours by the employee’s additional rate instead of the base rate. If left blank, the base rate will be used. Typically does not get pulled in – hours can only be paid under Fringe using a special calculation code.

- Rate – if you are paying the employee out for hours, then the hours will multiply against the rate entered here.

- Amount – if you are paying out the employee for a flat dollar amount, you would input that figure here.

- Goal – if set, then the fringe will pay out until the goal is met. Once it is met, the fringe will stop automatically.

- Paid – if a goal is set, then the system will keep track of the amount paid towards the goal. Once the goal = paid, then the fringe will stop.

- Units – typically used if you are posting GTL every payroll. The units would be the employee’s coverage amount for GTL.

- Minimum – the minimum amount that can be paid out to the employee in one payroll for this fringe.

- Maximum – the maximum amount that can be paid out to the employee in one payroll for this fringe.

- Year-to-Date Max – the annual amount that can be paid out to the employee. Once met, the fringe will no longer be paid out until the following year.

- Miscellaneous Info – For record keeping purposes, used to designate what this fringe was for. No impact on what will be paid out to the employee.

- Department – this is the CC1 (cost center) for the employee. This is usually left blank, which will attribute the fringe to the employee’s home cost center. Can be used to post this fringe to a different cost center.

- Location – this is the CC2 (cost center) for the employee. This is usually left blank, which will attribute the fringe to the employee’s home cost center. Can be used to post this fringe to a different cost center. Will only appear if you are using more than one cost center

- Job Code – if you are utilizing job codes, you can set it so the fringe will be attributed to a specific job code for reporting purposes. Typically left blank.

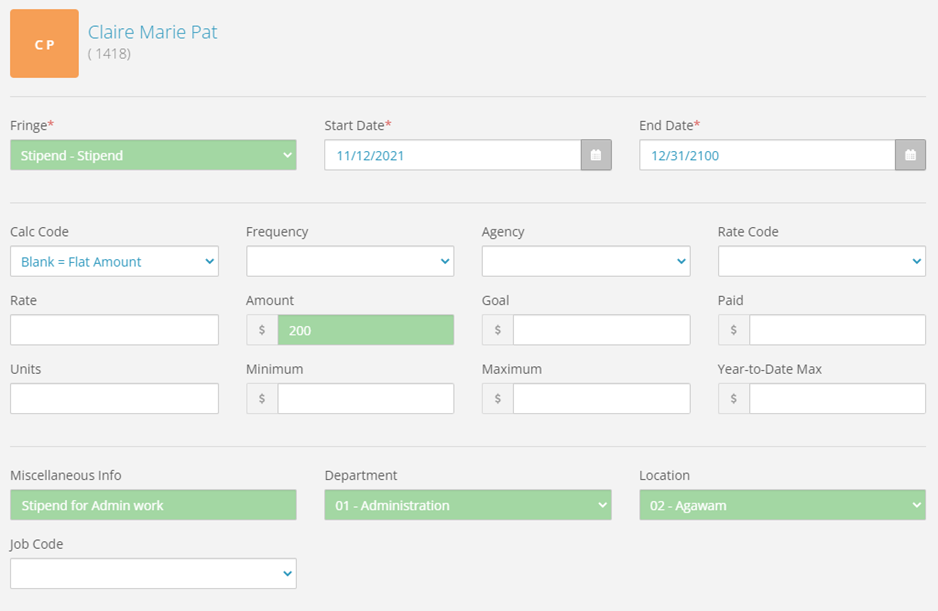

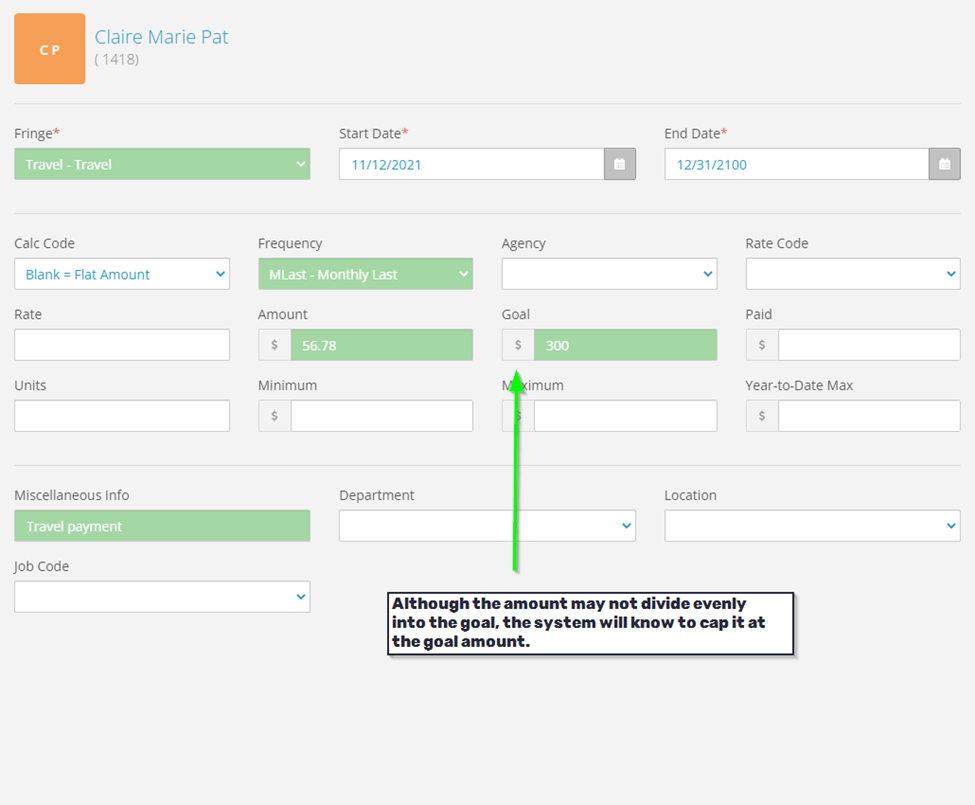

Not all fields will need to have information pulled in for the fringe to be added. Below are some examples of successfully added fringe earnings.

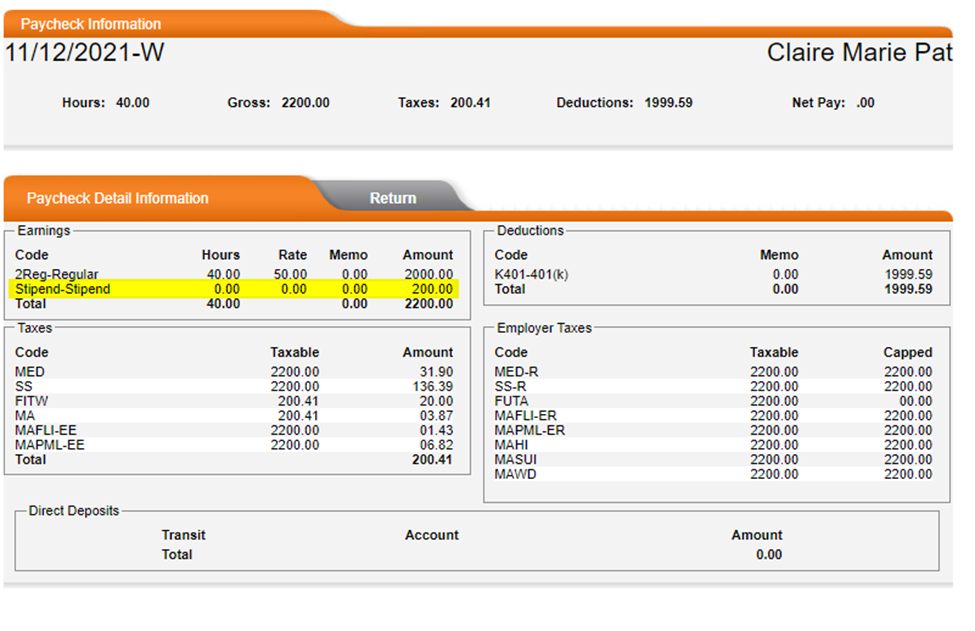

Flat $200 for a Stipend, going to different Cost Centers

Flat $56.78 for a Travel, paid once per month

Things to Note

Fringe will only process as an additional payment. This means the employee will need to receive a payment (either through ours or a dollar amount) for the fringe to appear.

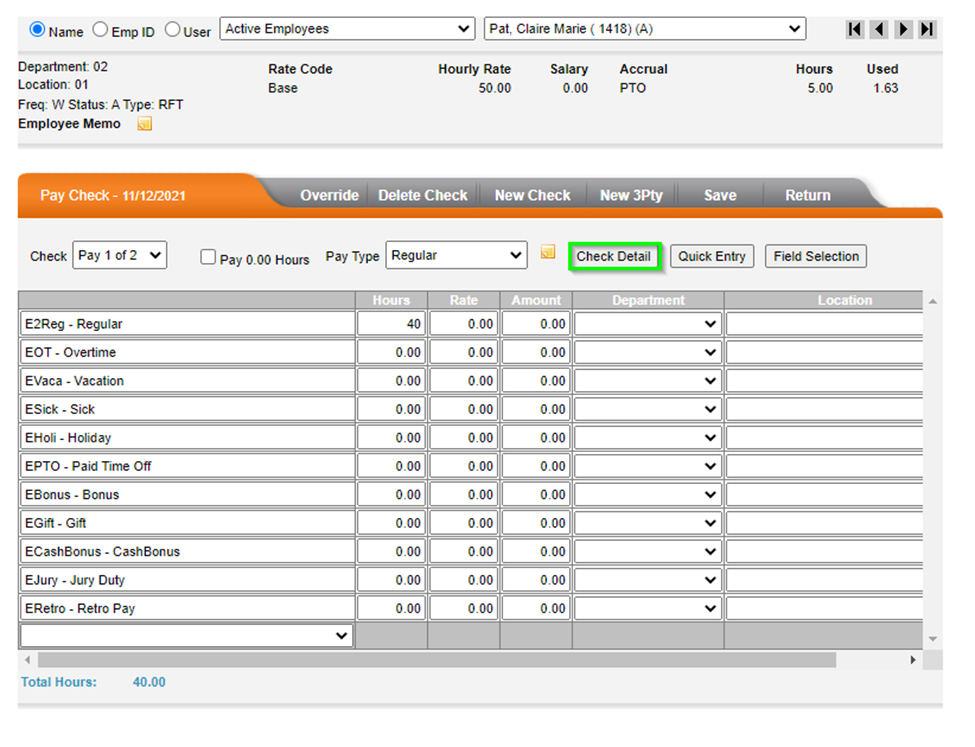

Unlike Auto Pay, Fringe will not appear as lines in the Detail Entry Method when working on the payroll. It will appear in the Check Detail preview as well as the Preprocess, however:

Fringe can be used to memo items in payroll as well such as Group Term Life (GTL) and employer portions of benefits such as health care.