How do I change an employee's tax filing status?

This article covers making changes to an employee's Federal or State Tax filing status in Checkwriters.

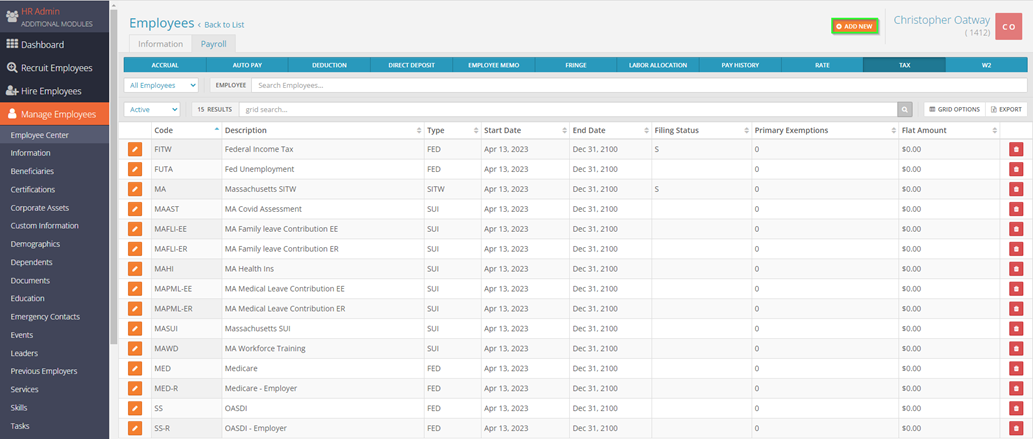

Select the employee you would like to edit under Manage Employees > Employee Center in the HR Admin module. Navigate to their Tax tab. You will see all taxes currently assigned to the employee here.

While there may be numerous individual lines (each line would reflect a different tax such as income tax, FICA, unemployment, etc), you will typically only ever need to edit two taxes*:

- FITW – this is for Federal Income Tax

- State Tax Withholding – the code for this will be your state abbreviation

-

- *Depending on your state, you may have additional local taxes that you would edit, or no state income tax status to edit at all. If your state does not have income tax, the status will default to ‘N/A’.

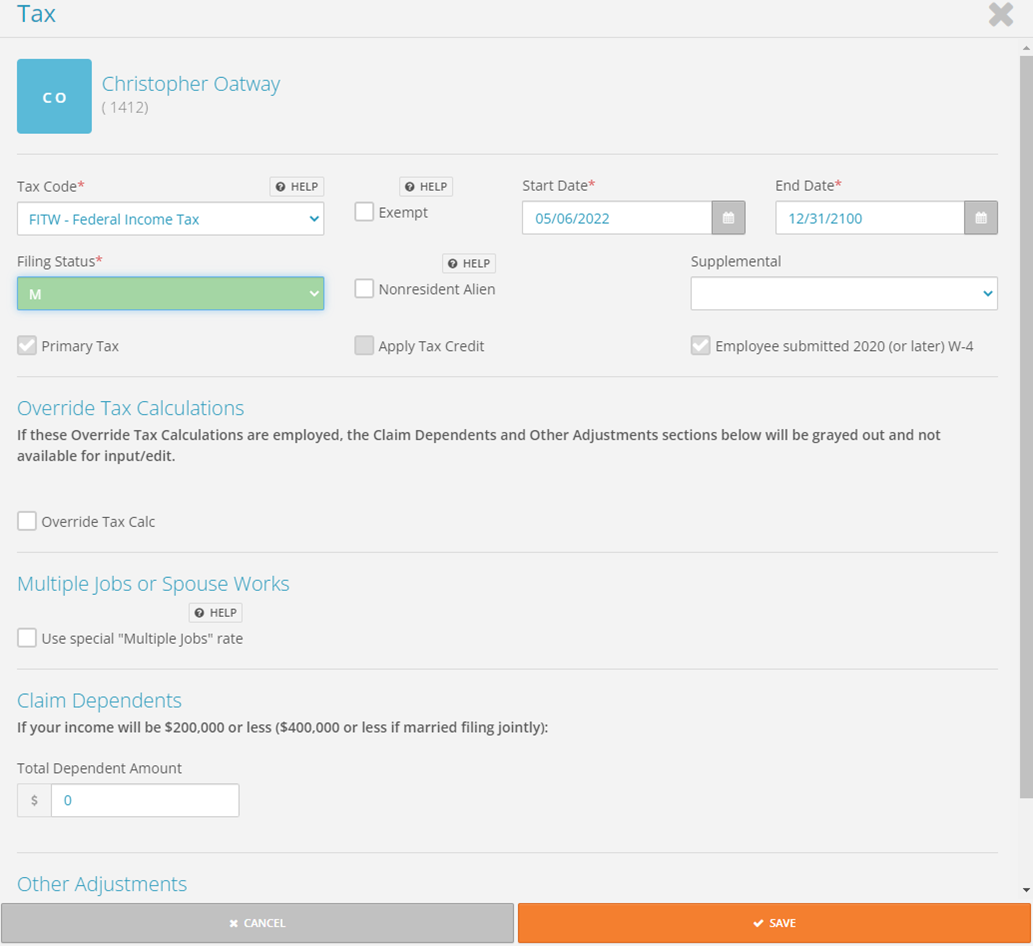

To add in a new filing status, select ‘Add New’ in the top right.

This will bring up the edit screen. In the Tax Code box, select the tax you would like to add in a new filing status for. Once this is pulled in, select the box the employee indicated a change for on their tax form (W4 or state withholding form) and input the new status. For example, if an employee was changing from Single to Married for their withholding status, you would select the Filing Status box and change it to M.

Once all the boxes you wish to change are highlighted green, you can hit Save to update the employee’s withholding.

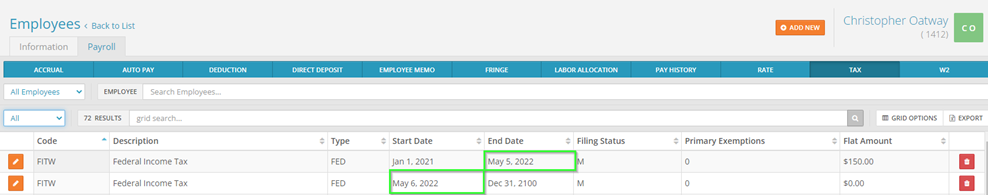

You will notice that a start date of your next check date automatically gets applied here. After this is added, it will automatically end the old filing status so that will be in a historical status, similar to how rate changes function. This will enable you to review an employee’s past filing statuses.

Things to Note

If an employee is requesting an additional amount to be withheld each payroll, you will need to fill in the ‘Additional Amount’ box with the extra amount they indicated.

While you can delete tax codes from an employee’s profile, it is strongly recommended that you contact our Client Support Team at support@checkwriters.com before doing so. If an employee is changing state taxes, you should also contact our Client Support Team at support@checkwriters.com adding/removing taxes and how it will impact payroll.

You will see an option for Override Tax Calc. If you check this off, then any amount or percentage you input will be withheld instead of having the system calculate the taxes for you.

You can mark an employee as exempt for Federal by checking off the Exempt box next to the Tax Code. For your State tax, you can mark an employee as exempt by inputting 99 in the exemptions box.