Determine your Federal Tax Liability

This will help determine if your Federal Tax Liability is over $100,000 which would require pre-funding for payroll due to the IRS Next-Day deposit rule.

PDF version of this article can be found here >> Federal Tax Liability Guide

What makes up your Federal Tax Liability?

- Employee Federal Tax Withholding (FITW)

- Employee (EE) Old Age Survivors Disability Insurance (OASDI) commonly known as Social Security (SS) and Medicare (MED) tax withholding

- Employer (ER) OASDI/Social Security (SS-R) and Medicare (MED-R) tax withholding

What is the Next-Day Rule?

The IRS $100,000 Next-Day Deposit Rule - Regardless of whether you are a monthly schedule depositor or a semiweekly schedule depositor, if you accumulate federal taxes of $100,000 or more on any day during a deposit period, you must deposit the taxes by the next business day after you accumulate the $100,000.

What does this mean for you?

When any payroll, or a combination of payrolls within an assigned deposit period, has a federal tax liability amount of $100,000 or more, the $100,000 Next-Day Deposit Rule applies. This means the IRS requires that the tax be paid by the next banking day.

How do I determine if my federal liability is $100,000 or more?

- Prior to submitting your payroll, run a preprocess register

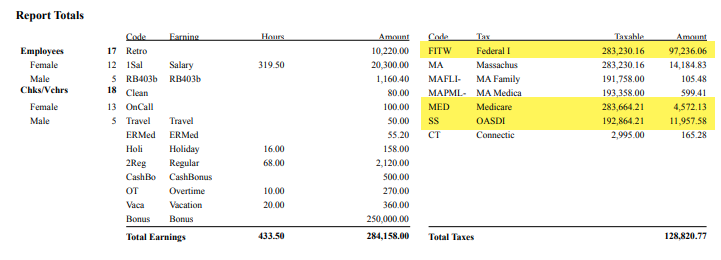

- Go to the totals on the last page

- Add the employee OASDI (SS) and employee Medicare (MED) withholding amounts and multiply by 2. Multiplying by 2 accounts for the employer portion of the tax.

- Add this amount to the employee federal withholding (FITW).

- The result will be your federal tax

Example:

(MED) $4,572.13 + (SS) $11,957.58 = $16,529.71 x 2 = $33,059.42 EE & ER SS/MED Tax Liability

$33,059.42 + (FITW) $97,236.06 = $130,295.48 Federal Tax Liability

If you continue to process payroll two business days prior to the check date, the total payroll liability will need to be wired to Checkwriters no later than 12:00 pm EST the day prior to your check date.

If you wish to maintain the standard ACH funding procedure, your payroll must be processed at least 5 business days prior to the check date.

For instructions on wiring funds and for any inquiries, please reach out to our Client Support Team at support@checkwriters.com. They will be able to provide you with the necessary information and assist you with any questions you may have.