All About Start and End Dates

This article will cover how Start and End Date function in Checkwriters.

Overview

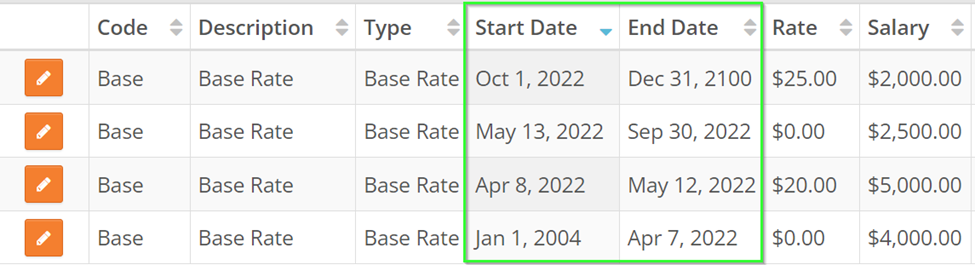

When reviewing different payroll items on an employee’s profile, you will notice there are Start Dates as well as End Dates. For example, here is an employee’s rate tab:

These dates signify what check date range these rates will be active. In the above example, the first rate was active from any payroll that fell on 01/01/2004 until any payroll that fell on 04/07/2022. Following that, the next rate was active from 04/08/2022 until 05/12/2022, and so on. Note – the current rate has an end date of 12/31/2100. This is common – this means that this rate is active for the foreseeable future. This date gets applied to any new payroll item you add unless you change it.

Checkwriters views dates for all payroll related items – Accruals, Deductions, Rates, etc – with the check date in mind. For this reason, you will want to be cautious when entering these in. Let’s review a scenario where an employee is receiving a raise.

Janet Arlene is set to receive a raise effective 07/03, which is the start of a new pay period. The company also has a payroll to process for 07/07, which pay period is the week before, prior to Janet’s raise effective date. If a start date of 07/03 is entered for the rate prior to working on the 07/07 payroll, then Janet’s new rate will be applied in that payroll. If the start date was entered as 07/08 or later, then the ‘old’ rate will still be applied in the 07/07 payroll.

Knowing this, what would the best practice option be? Ultimately, it is up to you in how you want it handled. The two best options would be:

- Input the new rate with a start date after the check date. This way, you can enter in the rate ahead of time and it will be ready to go for the next payroll. In the above example, 07/08 was used, but you can also input the following check date (let’s say 07/14) since that will be the first payroll with the new rate.

- Input the new rate after the payroll is processed. This way, you can input the actual effective date as the start date so it lines up with your internal records for employees.

In the above example, we were discussing a rate change, but keep in mind that the same process would apply for other items such as deductions.

Things to Note

- If an employee receives a raise in the middle of a pay period, Checkwriters will not calculate part of the pay at the old rate and part of the pay at the new rate. You will either have to manually enter in the old rate (if you made the rate change prior to working on payroll) or the new rate (if you are planning on entering the new rate after payroll processed or you are using a start date after the check date)

- If you are planning on entering in the new rate after the payroll has processed, you will need to confirm that the payroll has fully processed before the making the change. If you make the change while the payroll is processing, it could affect the payroll and pay the employee out at the new rate.

- Always keep the check dates in mind when making changes to employees’ profiles

- While Checkwriters views dates as check dates when you are running payroll, there is a difference when terminating/activating an employee. When an employee is activated, they are seen as active by the payroll immediately and will appear in your next payroll. When an employee is terminated, they are seen as inactive by the payroll immediately and will not receive a pay grid (as long as both are done prior to starting the payroll). If an employee is to be terminated on 07/20 but still has to receive a check on your 07/28 payroll, you will need to terminate them after the payroll containing their final pay processes. Conversely, if you activate an employee with a hire date of 07/31 prior to working on your 07/28 check date, then they will appear in the 07/28 payroll. You will need to review the payroll to ensure they are not receiving an early payment.