ACA Year-End Checklist

Reviewing your ACA records at the end of the year is essential to ensure proper reporting.

Use this checklist to ensure your ACA records are complete in preparation for year-end reporting.

- ✅Review Company Contact Information - This information can be found in the ACA Center >> Setup >> Co & Aggregate tab.

- ✅Review Cost & Compliance records for accuracy including any safe harbors that may apply.

- ✅Review Validation Report and correct errors.

- ✅Review Status records for accuracy and make edits as necessary. The ACA - Employee Status report will give you a full listing of status records for the reporting year.

- ✅For Self-Insured Health plans only - if you administer a self-insured health plan, verify that covered dependents are correctly recorded on the 1095C. The ACA - Dependent Status report will give you a full listing of status records for the reporting year.

- ✅ALE Member Groups - For employers who are part of an Aggregated Employer Group, verify that all members are included in the ACA Center >> Setup >> Co & Aggregate tab under Authoritative Transmittal Setup for ALE Member Groups.

- ✅Submit Records AFTER all records have been thoroughly reviewed. Records should not be submitted before January 1st.

Note: If your company is part of a multi-company employer group, the following may apply to you:

Small organizations with fewer than 50 Full-Time Employees (FTEs) are not classified as Applicable Large Employers (ALEs). However, common ownership may lead to the aggregation of smaller organizations for ACA purposes, resulting in a total FTE count of 50 or more.

More Info: Visit the IRS website to determine if this situation applies to your company: Determining if an employer is an applicable large employer.

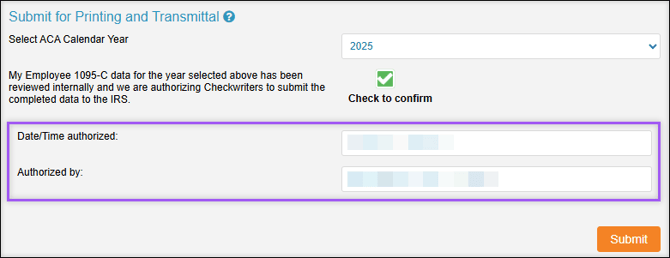

To submit, navigate to ACA Center → Setup → Co & Aggregate → Submit for Printing and Transmittal.

- Select the appropriate ACA Calendar Year from the dropdown menu.

- Select Check to Confirm, verifying that all employee 1095-C data has been internally reviewed and that Checkwriters can submit the data to the IRS.

- Select Submit. Upon successful submission, the Date/Time authorized and Authorized by fields will populate.

Note: If your organization is part of an ALE Member Group, all entities must be reviewed and submitted separately.

For additional questions, please contact Checkwriters ACA Team at ACATeam@checkwriters.com.