11/04/2025 Release Notes: SECURE 2.0 Act Catch-Up Deductions

These release notes document improvements to the Checkwriters software released to the Production environment on 11/04/2025.

The IRS recently released final regulations that provide guidance for retirement plans with catch-up contributions, reflecting statutory changes made by the SECURE 2.0 Act of 2022. In response to these regulations, Checkwriters has released the following updates to our system.

More Info: Learn more about the IRS Catch-Up Contributions Rule.

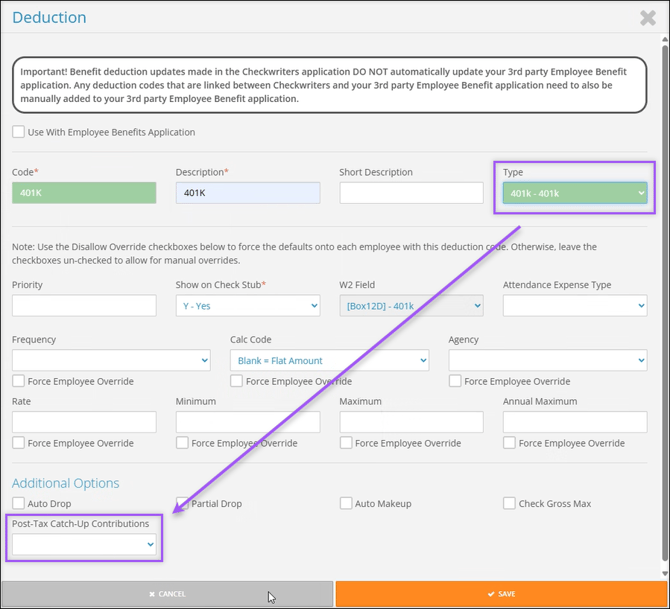

Company Deduction Changes

For users with access to Company (module) → Company Setup → Deductions, we have added new functionality.

When adding or editing a deduction code with a Type of “401k”, “403b”, or “457b”, a new dropdown field, Post-Tax Catch-Up Contributions, will display. This field allows administrators to configure which Roth deduction code will be automatically used for post-tax catch-up contributions. From the “Post-Tax Catch-Up Contributions” dropdown, users can designate the deduction as one of the following, as they are available:

- Roth 401k

- Roth 403b

- Roth 457b

- Roth IRA

- Roth Simple - Simple Roth IRA

- SBRSimple - Small Simple Roth IRA

Options in this dropdown are generated from the other Deduction types set up within your company. You will only see the above options in the Post-Tax Catch-Up Contributions dropdown if those Deduction types are set up in Company (module) → Company Setup → Deductions.

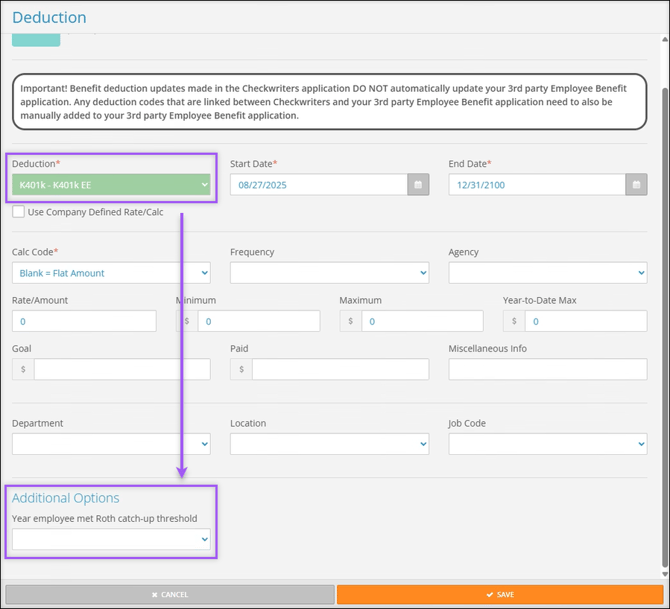

Employee Deduction Changes

For users with access to HR Admin (module) → Manage Employees → Employee Center → select employee → Payroll (tab) → Deduction (tab), we have added new functionality.

Note: This step only needs to be completed if either of the following are true of the employee:

- The employee is age 50+, made less than the Roth catch-up threshold in FICA wages the prior year, AND they have voluntarily elected to make their catch-up contributions on a Roth basis.

- The employee is age 50+, made at or above the Roth catch-up threshold in FICA wages the prior year, AND their prior year’s wages are not in Checkwriters.

- If their prior year wages are in Checkwriters, their contributions will be updated automatically.

When adding or editing an employee’s deduction code with the Type “401k”, “403b”, or “457b” for an employee, a new field, Year employee met Roth catch-up threshold, will prompt users to indicate if the employee has exceeded the Roth catch-up threshold.

- If the employee DID meet the Roth catch-up threshold the prior calendar year, select the prior calendar year from the dropdown menu.

- If the employee DID NOT met the Roth catch-up threshold the prior calendar year, select “N/A” from the dropdown menu.

The Year employee met Roth catch-up threshold field will only show if the Deduction selected is set up with a Type of “401k”, “403b”, or “457b” in Company (module) → Company Setup → Deductions, as shown in the Company Deduction Changes section of these release notes.